|

3 June 2015 last updated

|

|

| Annuities could rise as yields boosted by EU and US bond sell off |

|

Annuities could continue the recent increases in rates after the boost in 15-year gilt yields to 2.49% following investors action to sell off bonds in Europe as growth returns and pulling US Treasury and UK gilt prices lower.

Annuity rates are primarily based on the 15-year gilt yields which have increased by 28 basis points in the last few days.

A 28 point increase in yields would mean providers are likely to raise rates by 2.8% at some point in the future if yields remain at this level to improve further.

Bond markets have been hit around the globe as the European Central Bank (ECB) predicts the eurozone's recovery to continue and they have lifted the forecast for inflation to 0.3% for the year up from 0.0%.

10-year German Bunds gained 19 basis points on the day as investors sold bonds lowering the price and leading the 10-year US Treasury notes which gained 10 basis points. The world markets are being driven by the unique Europe after the ECB

launched quantitative easing.

|

|

|

| |

Annuities could rise as growth returns to Europe and investors

sell off bonds increasing yields |

|

|

|

| |

|

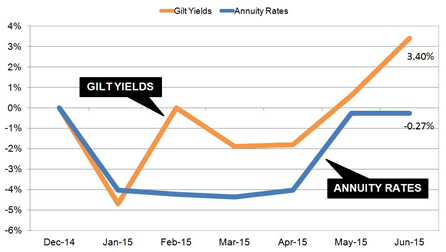

Annuities lagging behind gilt yields

Standard annuity rates have been lagging behind gilts for most of the year with providers resisting the recovery in the 15-year gilt yields since reaching an all time low in January of 1.68%.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart is based on our benchmark example for a 65 year old with a fund of £100,000 buying a single life, level annuity. The gap suggests rates could increase by up to 3.67% and if this was the case it would mean a rise of £210 pa from the current level of £5,738 pa to £5,948 pa.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £3,633 more over his lifetime. For a female she can expected to live for 20.4 years increasing her income by £4,284.

Volatility expected to continue

The US Treasury market has been tethered to Europe since the ECB launched their €1.1 trillion quantitative easing programme which buys €60 billion of bonds per month into the eurozone.

Even though US yields are higher than Europe, 10-year notes at 2.38% compared to German Bunds at 0.90%, Treasury notes are still following. This is contrary to the fundamentals of the US market and if yields continue to rise past 2.40% they could continue towards 2.60%.

The ECB have not yet suggested

they will take any action to slow down the recent European rates rise.

In the short term we could see further rise in pension annuities off the back of the bond sell offs in the EU and US although there could be volatility in the markets during the summer with providers quick to lower rates at the first sign of weakness.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|