|

20 December 2023 last updated |

|

| Annuity rates at risk with lower gilt yields as inflation falls to 3.9pc |

|

| |

Gilt yields plunge -71 basis points in December as inflation falls to 3.9% putting annuities at risk. |

|

|

|

|

|

Annuity rates are at risk after gilt yields reduce by 71 basis points after the Bank of England leave interest rates unchanged and inflation falls to 3.9% the lowest level in two years.

Annuity rates were lower in November and are expected to continue to fall after 15-year gilt yields plunge -71 basis points to a nine month low of 3.89% by 20 December 2023.

Gilt yields reached a fifteen year high of 5.13% on 23 October 2023 and has since reduced 124 basis points with annuity rates reaching a high on 1 October 2023.

Find related news here:

Gilt yields reduce 53 basis points with no prospect of interest rate rise

Annuities peak with falling gilt yields and unchanged interest rates

The dramatic reduction in gilt yields is due to the Federal Reserve and Bank of England leaving interest rates unchanged.

Analyst are expecting interest rates to fall sharply next year with the first reduction in June 2024 although some are now looking as early as March 2024.

In the UK inflation is reducing quickly from 6.7% in August and September to 4.6% in October and unexpectedly to 3.9% in November 2023.

|

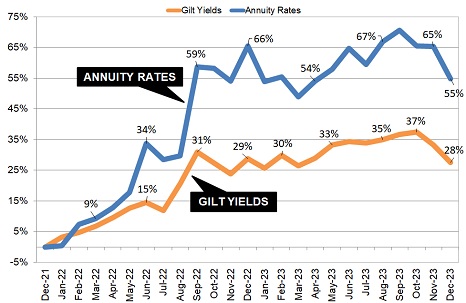

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating income reaching a peak income of £4,638 pa in September 2023. Since then it has reduced -£431 pa or -9.2% to £4,207 pa by December remaining 55% up since December 2021.

In comparison our benchmark example of a 65 year old using £100,000 to purchase a single life and level income is still at a thirteen year high. It has reduced -£587 pa or -7.8% from £7,447 pa ar the start of October to £6,860 pa in December 2023.

Interest rates were increased by the Bank of England to 5.25% in August 2023 after the Consumer Price Index (CPI) reached a high of 11.1% in October 2022.

The Governor of the Bank of England Andrew Bailey has insisted it is too early to consider reducing interest rates, although the bank is now under greater pressure to do so with rapidly falling inflation.

The bank has projected inflation reaching the 2% target by the end 2025 with interest rates at 4% by the end of 2024 and 3% by the end of 2025.

With gilt yields falling fast providers are likely to reduce annuities further in the remaining weeks of December although there are still opportunities to secure annuity incomes which remain at a thirteen year high.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|