|

16 April 2023 last updated |

|

| Annuity rates could rise 2pc as gilt yields recover after banking crisis |

|

| |

Gilt yields climbs 32 basis points since the banking crisis and annuity rates could rise 2%. |

|

|

|

|

|

Annuity rates could rise 2% in the short term as gilt yields recover 32 basis points from the March low after uncertainty caused by the banking crisis and bailout.

After the bailout of Silicon Valley Bank (SVB) and Credit Swiss in March the 15-year gilt yields reached a low of 3.64% on 24 March 2023.

As the risk of contagion reduce, investors have return to inflation and the expectation of central banks to raise base rates sending yields 32 basis points higher at 3.96%.

In the US data revealed a rise in core inflation and comments from the Federal Reserve suggest inflation remains too high. The futures market have a 75% expectation that base rates will rise by 25 basis points at the next Fed meeting. This is likely to continue to meet the Fed target of between 5% and 5.25%.

Find related news here:

Gilt yields lower by 34 points with fear of contagion from bank bailout

Annuities could rise 4pc as Fed more hawkish with higher inflation

Pension annuities remain at a twelve year high and providers could raise annuity rates by about 2% in the short term. During 2023 providers have suffered from administrative delays due to the high volumes of applications for annuities received since October 2022.

Most providers have recruited significant numbers of staff to manage the increased volume and this could result in more competition and higher annuity rates.

|

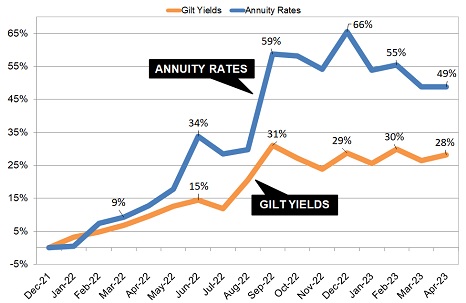

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart is based on our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating annuity which remains at a twelve year high. For people aged 60 with 3% escalating annuities the rise in rates since December 2021 is 49% and exceeds the rise in gilt yields of 28% over that time.

Depending on age and the features for an annuity December 2021 when annuity rates were near an all time high, there is a large difference between the rise in rates since December 2021 from +20% to +64%.

The largest percentage rise is for those aged 55 years old with a fund of £100,000, annuity on a 50% joint life and 3% escalation with pension income rising +64% or £1,256 pa. This is more than twice the rise shown in the chart above.

The largest monetary gain with a fund of £100,000, is for those aged 55 years with 100% joint life and level income with percentage rise of +52% and monetary amount of £1,737 pa.

The next Federal Reserve meeting is 2-3 May with a 75% chance interest rates will be raised by 0.25% from the current level of 4.75% to 5.00%.

Providers are increasing annuity rates due to higher gilt yields and competition although this may be limited to 2% in the short term.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|