|

26 October 2018 last updated |

|

| Annuity income hit by volatility in global equity and gilts market |

|

Recent falls in global equity markets and gilt yields has made buying annuities more difficult as pension fund values are lower reducing the lifetime income from an annuity.

Equity markets around the world have reduced with about $5 trillion in value wiped from the global stock and bond markets in October.

The FTSE-100 index has reduced 938 points or 11.9% from a high of 7,877 in May to the current level of 6,939.

The

15-year gilt yields reached a high for the year after rising rapidly to 1.85% in October and reduced by 29 basis points in the last two weeks to 1.56% as investors seek the safety of bonds and gilts.

Annuity rates are predominately based on gilt yields which have returned to the mid 1.5% levels seen during the summer.

Since this time providers have not followed the rise in yields since September but instead reduced annuity rates gradually by about 2% so limiting the impact of recent gilt yield falls.

|

|

|

| |

Equity markets fall sending pension funds 8% lower for the year with no change in annuity rates |

|

|

|

| |

|

Equity falls force delay to buy annuities

Many people remain invested until they buy their annuity and recent falls in equity markets may mean delaying this decision until a recovery in pension fund values.

Equity markets are falling due to a complex mix of rising US interest rates, slowing growth in China and Italy's debt risk to Europe with investors de-risking to safe havens such as bonds and gilts.

|

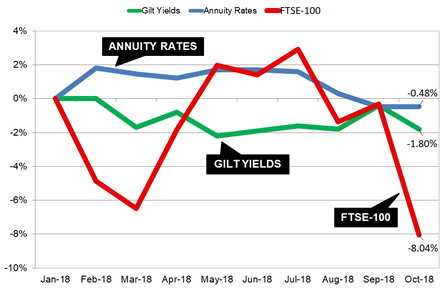

| Fig 1: Chart comparing the FTSE-100 index, annuity rates and gilt yields |

The above chart compares the change in the FTSE-100 index, standard annuity rates and 15-year gilt yields since January 2018.

Both annuity rates and gilt yields have been plus/minus 2% since the start of the year, however, equities have been volatile and are now -8.04% lower for 2018.

For our benchmark example of a person 65 year old with a £100,000 fund at the beginning of the year, they could purchase an annuity on a single life, level basis with income of £5,546 pa. By delaying buying an annuity their pension fund tracking the FTSE-100 index would be worth £91,960 and annuity today would be £5,076 pa or a difference of £470 pa.

In terms of total income during their life, the Office of National Statistics (ONS) would expect a male to live for 18.5 years and he will have -£8,695 less over his lifetime. For a female she can expected to live for 20.9 years decreasing her lifetime income by -£9,823.

Although equity markets may make a small bounce back over the next few days, further uncertainty is expected in the markets over the following weeks until a support level is reached.

There are fears that the slowdown in the Chinese economy may be the catalyst that results is a downturn to the global economy and the US tariffs against China could enhance this outcome.

Pension funds may not return to the highs of summer 2018 until next year so for people buying their annuity and cannot wait may have no choice but to buy at current values.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|