|

15 May 2024 last updated |

|

| Retirement income up 121pc with record high annuity rates and equity markets |

|

| |

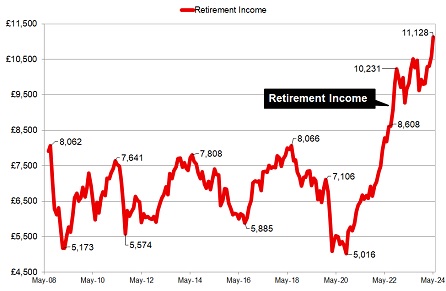

Retirement income is up 121.8% with record annuity rates and FTSE-100 index for 2024. |

|

|

|

|

|

Retirement income is up 121% since the low reach in 2020 with high annuity rates rising equity markets expecting current interest rates to fall this year.

The buying power of a pension fund for those that remain invested reached a low of £5,016 pa in October 2020 and has increased by 121.8% to £11,128 pa.

This is due to the combination of rising equity markets with the FTSE-100 index at 8,445 and annuity rates still at a fourteen year high following a surge in gilt yields in 2024.

Interest rates in the UK reached a high of 5.25% in August 2023 with annuity rates and 15-year gilt yields reaching a peak in the following months although this is likely to change before the summer.

As inflation has continued to reduce across the developed world equity markets have increased and there is now an expectation of central banks cutting interest rates this year.

In the UK the consumer price index (CPI) reduced from 11.1% in October 2022 to 3.2% in March 2024 and analysts expect the Bank of England to reduce interest rates at the August meeting. If interest rates are cut in August, gilt yields and annuity rates are likely to reduce before this date.

Find related news here:

Annuity and yields rise as Fed talk of rate hikes with higher US inflation

Gilt yields at record high after strong US data and dashed rate cut hopes

Our benchmark example records the buying power of a pension over time starting with a fund of £100,000 in July 2008 tracking the FTSE-100

index.

This is combined with annuity rates for each month based on a 65 year old in good health buying a lifetime

annuity on a single life and level basis, starting with an annuity in July 2008 of £7,908 pa.

The chart below shows how the buying power of a £100,000 pension fund has changed over time with an increase and decrease in fund value and annuity rates, this is the income that could be generated.

|

| |

Benchmark annuity rates and FTSE-100 index |

|

| |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

| FTSE |

7,455 |

7,729 |

7,628 |

7,630 |

7,952 |

8,144 |

8,445 |

| Rate |

£7,208 |

£6,860 |

£6,960 |

£7,295 |

£7,012 |

£7,048 |

£7,130 |

|

Fig 1: Chart and table comparing retirement income from 2008 to 2024 |

The FTSE-100 index reached a low of 5,577 in October 2020 with the 15-year gilt yields reaching a low of 0.162% in March 2020 due to the Covid pandemic.

The situation has been transformed in the last four years, with the FTSE-100 index rising to a record 8,445 and gilt yields currently at 4.45%. Although annuity rates are slightly lower than earlier in the year, our benchmark example a 65 year old with £100,000 purchasing a single life and level basis receives an income of £7,130 pa.

For those invested with a fund of £100,000 in July 2008 could purchase an income of £7,908 pa and now with a fund tracking the FTSE-100 index, higher equity markets and annuity rates can purchase an income of £11,128 pa.

We are reaching the pivotal point of fourteen year high annuity rates and record high equity markets boosting retirement income which is likely to change with lower UK inflation.

The Bank of England chief economist Huw Pill said on 14 May 2024 it was not unreasonable to expect the Bank to consider cutting interest rates over the summer. Mr Pill said there was some way to go to achieve and maintain the Bank's 2% inflation target and the forthcoming inflation and wages data would be important indicators.

Both gilt yields and annuity rates are likely to decrease before the Bank of England cuts interest rates which analysts expects for the 1 August 2024 Monetary Policy Committee (MPC) meeting.

Annuity rates are on average 45% higher than the low in December 2021 with some annuity incomes higher. The biggest percentage gain is for those in good health aged 55 years with 50% joint life and 3% escalation up +89%.

If you are retired or retiring and considering annuity income for part or all of your pension fund, now is the ideal time to secure the current high annuity rates before they start to decrease, possibly as early as this summer.

This also applies if you have cash in your bank as you can access secure income using a purchased life annuity with the benefit that the majority of the income is deemed a return of capital and therefore tax free.

To find out how the record rise in annuity rates has increased your retirement income for your age, click this link annuity rates table.

|