|

15 February 2022 last updated |

|

| Pension annuities rise 9pc ahead of higher base rates in 2022 |

|

| |

Pension annuities rise 9% as gilt yields bounce 58 basis points in 2022 due to inflation fears |

|

|

|

|

|

Pension annuities have increased 8.9% in the last year after a strong bounce in gilt yields up 58 basis points in 2022 as investors expect higher base rates from central banks.

Over the last year pension annuities risen 8.9% and providers have increased rates by 2.15% in February as 15-year gilt yields are now 58 basis points higher at 1.72%. This is due to investors expecting central banks to be more aggressive with higher base rates to counter inflation.

For our benchmark the annuity income reached a low in January 2021 of £4,786 pa during the Covid lockdown and in just over a year has increased 8.9% or £429 pa to £5,215 pa.

Inflation has been driven as economies start post lockdowns resulting in supply bottlenecks around the world. The lack of supply together with significant rise in the cost of fossil fuels has seen the UK Consumer Prices Index (CPI) rise by 5.4%. In the US inflation has reached 7.5% the highest level in 40 years.

Find related news here:

Annuity rates higher as gilt yields reach recent highs on inflation fears

Gilt yields higher as central banks may raise rates faster than expected

The Bank of England has increased base rate twice since December 2021 and lastly in February 2022 to 0.5%. The Federal Reserve has indicated a more aggressive approach to raising base rates multiple times during the year starting in March.

|

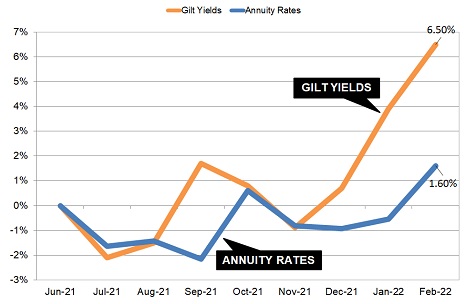

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows annuity rates for our benchmark of a person aged 65 years old with a fund of £100,000 buying a lifetime annuity on a single life, level basis and compares this to the 15-year gilt yields.

Since June 2021 pension annuities have been mainly down -1% to -2% and only increasing +1.6% in February 2022 when yields achieved recent highs as investors sell bonds and gilts looking for better returns ahead of higher base rates.

Annuity rates are mainly based on the 15-year gilt yields which have increased 88 basis points from 0.88% on 13 December 2021 to 1.72% nine weeks later on 15 February. Taking account of the current rise in annuities since December, this would suggest rates could rise a further 6.2% should gilt yields remain at this level.

Over the last year our benchmark annuity income increased £429 pa from £4,786 pa to £5,215 pa.

In terms of total income during their life, the Office of National Statistics (ONS) would expect a male to live for 18.5 years and he will have £7,936 more over his lifetime by taking an annuity now compared to a year ago. For a female she can expected to live for 20.9 years increasing her lifetime income by £8,966.

Inflation is likely to remain high at least for this year and central banks including the Bank of England and Federal Reserve are expected to be aggressive by increasing base rates two or more times during 2022.

The 15-year gilt yields could continue to rise further and if providers perceive this will remain high in the medium term, annuity rates are likely to continue to rise in the spring

to match yields.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|