|

28 July 2023 last updated |

|

| Annuity rates at risk as inflation falls with gilt yields 52 basis points lower |

|

| |

Gilt yields reduce 52 basis points with annuities at risk as inflation falls faster than expected. |

|

|

|

|

|

Annuity rates are at risk after a surprise fall in US and UK inflation sends gilt yields 52 basis points lower as analysts expect central banks to end higher interest rates sooner.

After the 15-year gilt yields reached a high this year of 4.91% on 7 July, falling inflation figures in the US and UK resulted in a -52 basis points fall in yields to 4.39% on 24 July.

Annuity rates are mainly based on the movement of gilt yields and are at risk of falling with some providers such as Just Retirement and Legal & General already reducing the income for some annuities.

Find related news here:

Yields rise further as central banks plan for more interest rate hikes

Annuities rise 4pc with soaring gilt yields due to high inflation for longer

Gilt yields have recovered slightly by 16 basis points in the last week from 4.39% to 4.56% and is almost to the same level at the start of the month.

Consumer price inflation (CPI) in the US surprised analysts by reducing more than expected from 4% in June to 3% recorded on 12 July. The Federal Reserve has increased interest rates by 0.25% to a range of 5.25%-5.50% on 26 July.

In the UK the consumer price index reduced from 8.7% in June to 7.9% recorded in on 19 July when analysts were forecasting 8.2% indicating inflation is starting to fall faster than expected.

The Bank of England is expected to raise base rates by 0.25% to 5.25% at their next meeting on 3 August.

|

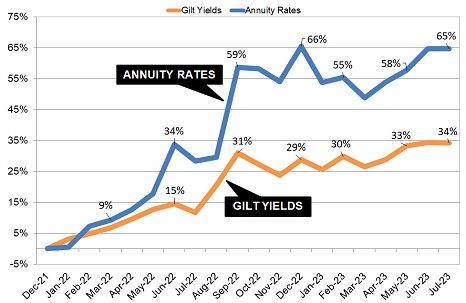

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart is based on our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating annuity which remains at a fourteen year high.

Annuity rates have reached a high in 2023 and since the low of December 2021 our benchmark income was at £2,719 pa and has since increased 65% to £4,478 pa. For a 65 year old with a fund on a level basis the income in

December 2021 was at £5,085 pa increasing 645% to £7,352 pa.

This compares to gilt yields rising by 38% by 7 July and close to the high after the mini budget in September, falling back to 34% higher due to falling inflation.

For some ages and annuity features the percentage rise since December 2021 is higher than shown in the above chart. Income received from annuities are at a 14 year high and are at income levels you could receive 20 years ago.

For those aged 55 years old with a fund of £100,000, the biggest percentage rise is a 50% joint life annuity with 3% escalation and income up +84% or £1,674 pa since December 2021.

The largest monetary gain with a fund of £100,000, is for those aged 70 years with 50% joint life and level income with percentage rise of +48% and monetary amount of £2,552 pa.

Providers have increased annuity rates in the last two months based on 15-year gilt yields rising further. If the expectation is central banks are coming to the end of the interest rate rise, annuities may have reached their peak.

This is more likely to be the case if inflation reduces further in the next couple of months and we will see providers reducing annuity rates if gilt yields fall to under

4.0%.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|