|

8 April 2024 last updated |

|

| Annuity rates could recover 3pc as strong US economy send yields higher |

|

| |

Gilt yields are back up 14 basis points to 4.42% with the prospect of annuity rates rising +3%. |

|

|

|

|

|

Annuity rates could recover +3% after strong US jobs date sends gilt yields higher to 4.42% and confirms interest rates will be higher for longer.

After providers reduced annuities last month, strong US jobs data sends gilt yields +14 basis points higher to 4.42% and annuity rates could recover by +3.08% in the short term.

Analysts had expected only 200,000 more jobs created in the US economy whereas the Labor Department data showed 303,000 jobs in March compared to 270,000 in February.

This shows the strength of the US economy and the Federal Reserve is unlikely to cut interest rates until later in the year. Analysts had expected the first of four rate cut as early as May 2024 and this has reduced to two rate cuts in the second half of the year.

Find related news here:

Pension annuities fall 3pc with lower yields and talk of interest rate cuts

Gilt yields rise to record level as interest rates stay higher for longer

The 15-year gilt yields reached a high of 5.13% on 23 October 2023 reducing -118 basis points to 3.95% by the end of December as inflation fell in developed economies. Yields increased again by +50 basis points to 4.45% by the end of February 2024.

Last month gilt yields reduced -17 basis points from 4.45% last month to 4.28% as the Swiss central bank was the first major central bank to cut interest rates on 21 March by -0.25% to 1.50%.

This fall has been reversed with a +14 basis point rise to 4.42% on 5 April 2024 and gilt yields are likely to remain volatile going forward.

|

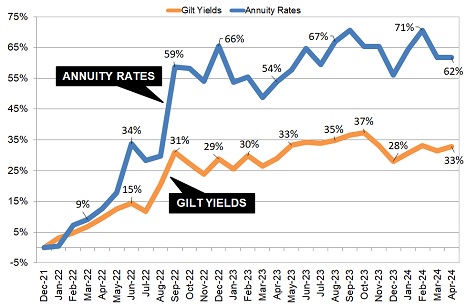

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating income reaching a peak income of £4,641 pa in February 2024.

Since then it reduced -£241 pa or -5.1% to £4,400 pa and this income is 62% higher than the recent low in December 2021. This gilt yields improving in March it is possible annuity rates will move back to the peak level.

In the UK

consumer price index (CPI) inflation reduced from 4.0% in January to 3.4% in February whereas US inflation remains higher than expected.

Data released by the British Retail Consortium shows shop price inflation fell from 2.5% in February to 1.3% in March, which is the slowest rate since December 2021.

Food price inflation fell from 5.0% in February to 3.7% in March and non-food inflation also reduced from 1.3% in February to 0.2% in March.

The Bank of England could have an opportunity to reduce interest rates in the 1 August Monetary Policy Committee (MPC) meeting and this could be before the Federal Reserve cuts rates.

If this happens

gilt yields will reduce and providers will reduce annuity rates. The likely hood of this happening depends on how quickly inflation falls in the next quarter.

Until then annuities are still at a fourteen year and the opportunity exists establish secure annuity income at these higher rates which could start to fall by August 2024.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|