|

31 October 2022 last updated |

|

| Pension annuities up 47pc this year with extra help from Mini Budget |

|

| |

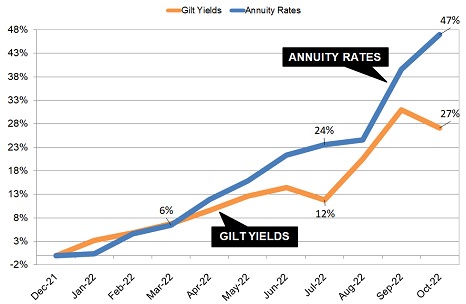

Pension annuity rates rise up to 47% during 2022 with higher gilt yields and the Mini Budget.

|

|

|

|

|

|

Pension annuities increase by a record 47% during 2022 to a fourteen year high as gilt yields rise due to central bank base rates and the Mini Budget uncertainty.

Income from annuities is up a record 47.0% or £2,400 during 2022 reaching a fourteen year high with almost half of this rise is due to the Mini Budget.

This is

based on our benchmark example of a 65 year old with £100,000 purchasing, single life, level annuity with the highest rise for those age 55, level annuity. The highest rise is for a 50% joint life annuity with 3% escalation rising by 90.7% over ten months.

After the 23 September Mini Budget annuities increased an average of 20% in three weeks to 14 October with the biggest rise for those aged 60 year old with a fund of £100,000, purchasing a single life with 3% escalation. This has increased by 33% or £1,164 pa, from a low of £3,526 pa to £4,690 pa.

Find related news here:

Annuity rates increase 15pc as Mini Budget sends yields to record levels

Annuities rise 12pc to thirteen year high after Mini Budget fallout

At the start of the year both the 15-year gilt yields and pension annuities remained at near record lows due to the impact of the Covid pandemic. Annuities are up 47% and yields up 27% this year.

The combination of a global economic re-start, supply chain problems, the European war, rapid inflation and fallout from the Mini Budget have conspired to create the perfect storm sending pension annuity rates up by 32% to 90% for certain ages and annuity features.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example of a 65 year old in good health buying a lifetime annuity with £100,000 on a single life and level basis.

In December 2021 annuity income was £5,085 pa while gilt yields remained low at 1.14% and since then annuity rates increased 47.0% or £2,389 pa to £7,474 pa.

The 15-year gilt yields increased as high as 5.09% or up 395 basis points by 12 October and since the appointment of Rishi Sunak as Prime Minister reduced to 3.85% or up 271 basis points for the year.

The highest rise is for a 55 year old with a fund of £100,000, purchasing a 50% joint life with 3% escalation. This has increased by 90.7% or £1,803 pa, from a low of £1,986 pa in December 2021 to £3,789 pa in October 2022. This means if you live to age 88 the income is guaranteed to increase to £10,049 pa.

Compared to possible lifetime income from an annuity in December 2021 for our benchmark annuitant aged 65, the Office of National Statistics (ONS) would expect a male to live for 18.8 years and he will have £44,913 more over his lifetime by taking an annuity now compared to a December 2021. For a female she can expected to live for 21.2 years increasing her lifetime income by £50,646.

Annuities have increased +20% more

than gilt yields in 2022 whereas gains up until August were very similar.

This suggests the providers are pricing in further increases in gilt yields in the next six months due to central bank's raising base rates and annuity rates may remain at the current level, fall or rise slightly until further progress is made by the 15-year gilt yields.

|