|

18 January 2024 last updated |

|

| Gilt yields soar 45 basis points and pension annuity rates rise rapidly |

|

| |

Annuities rise rapidly after gilt yields soar 45 basis points with higher US and UK inflation. |

|

|

|

|

|

Pension annuity rates increase up to +6.5% after gilt yields soar 45 basis points expecting interest rates to be higher for longer due to rising US and UK inflation data.

Providers increase pension annuity rates up to +6.5% in January due to soaring 15-year gilt yields up 45 basis points to 4.41%. Gilt yields increased as analysts expect interest rates to remain higher for longer as inflation in the US and UK increased unexpectedly.

For our benchmark example of 55 year old using £100,000 to purchase a 50% joint life and 3% escalating income increased by +£231 pa or +6.5% to £3,778 pa in January. This has increased 90% since the recent low in December 2021 and very close to the recent high of 91% recorded in September 2023.

Gilt yields reduced significantly to 3.95% in December as inflation reduced and analysts were discussing the date central banks would start reducing interest rates.

Find related news here:

Annuities down 4pc with falling gilt yields expecting lower interest rates

Annuity rates at risk with lower gilt yields as inflation falls to 3.9pc

Yields reached a fifteen year high of 5.13% on 23 October 2023 reducing -118 basis points by the end of December with analysts predicting the first interest rate cuts by the Federal Reserve as early as March 2024.

|

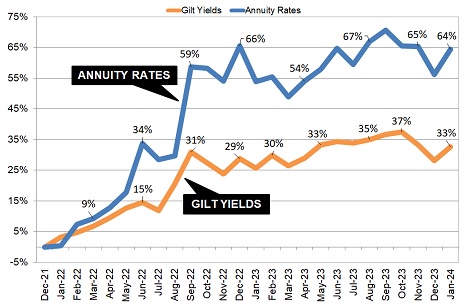

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating income reaching a peak income of £4,638 pa in September 2023.

Since then it reduced -£393 pa or -8.4% to £4,245 pa by December and providers increased annuity rates in January by +£224 pa or +5.2% to £4,469 pa. This income is 64% higher than the recent low in December 2021.

The consumer price index (CPI) in the US increased from 3.1% in November to 3.4% in December. In the UK CPI inflation reduced from 6.7% in August and September to 4.6% in October, 3.9% in November and increased to 4.0% in December 2023.

Inflation may rise slightly in the first quarter of the year if the Houthi drone and missile strikes continues in the Red Sea forcing global shipping to take the long route round Africa increasing transport costs for consumer goods.

The recovery in annuity rates in January could be maintained until April although it is likely energy cost will reduce by May sending inflation lower for the summer. If this occurs, the Bank of England would have some scope to reduce interest rates before the next election in the autumn 2024.

As annuities remain at a fourteen year, there is an opportunity to secure higher annuity income in the first quarter as the risk is higher that annuity rates will fall again in the summer with lower interest rates.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|