|

16 January 2023 last updated |

|

| Annuity rates up 42pc last year and record levels of retirement income |

|

| |

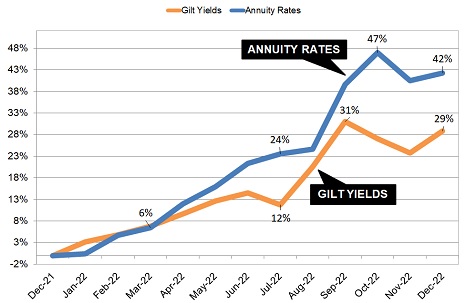

Annuity rates up 42% in the last year as gilt yields rise 50 basis points in December 2022. |

|

|

|

|

|

Annuity rates are up 42% last year after gilt yields rise to end the year at 4.02% as investors expect central banks to increase base rates further.

Income at retirement is at record levels following a rise in the 15-yeaqr gilt yields to 4.02% with an average rise in annuity rates of 42.2% during 2022.

These annuity rates were common eighteen years ago and gives people retiring now the opportunity to secure a guaranteed income at these record levels.

For annuities with certain ages and features the rise is more dramatic such as those aged 55 years old buying a 50% joint life annuity with 3% escalation rates are higher by 80.6%.

Find related news here:

Annuity rates still at thirteen year high even with lower gilt yields

Gilt yields reach fourteen year high of 5.09pc with record annuity rates

The impact of restarting the economy after the pandemic and European war increasing energy costs has driven consumer price inflation (CPI) in the UK to 10.7% by November 2022.

To counter inflation central banks are raising base rates and this has resulted in investors selling gilts and raising yields. As annuity rates are mainly based on 15-year gilt yields we are now recording increases although the window of opportunity is likely to close this year.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example of a 65 year old in good health buying a lifetime annuity with £100,000 on a single life and level basis.

Since December 2021 the biggest monetary gain is for those aged 70 purchasing an annuity with 100% joint life and level income with percentage rise of +46% or monetary amount of £2,227 pa.

The lowest monetary amount is for those aged 55 purchasing an annuity with 50% joint life and 3% escalation up £1,602 pa even though the percentage rise is the highest at +80%.

You can find more about this at our annuity rates table page.

Biggest annuity gains

For single life annuities with a fund of £100,000 on a level basis and no guaranteed period, the increase in income in the last year ranges from £2,031 pa for a 55 year old to £2,213 pa for a 75 year old. For a 50% joint life annuity on a level basis the increase income is £2,120 pa for a 55 year old to £1,810 pa for a 75 year old.

Taking the above example, for a 55 year old the rate is 5.9% or income of £5,901 pa which has increased by +52% or £2,031 pa since last year. For a 75 year old the rate is 9.1% or income of £9,167 pa which has increased by +32% or £2,213 pa since last year.

The biggest improvements are annuities with escalation and for a 55 year old on a single life with 3% escalation the income rise is +72% or £1,633 pa since last year whereas for a 75 year old the income rise is +37% or £1,993 pa since last year.

For an annuity with 50% joint life and 3% escalation a 55 year old has seen pension income rise +80% or £1,602 pa since last year and a 75 year old has seen pension income rise +36% or £1,750 pa since last year.

For enhanced annuities the gains are similar with the biggest monetary gain for those aged 70, single and level income with a rate of 10.3% or income of £10,396 pa. The monetary gain is +29% or income of £2,317 pa.

The biggest gain for enhanced annuities is 50% joint life and 3% escalation a 55 year old has seen pension income rise +78% or £1,636 pa since last year.

The range of gains for single life annuity on a level basis the increase income is £2,078 pa for a 55 year old to £2,307 pa for a 75 year old. For a 50% joint life annuity on a level basis the increase income is £2,112 pa for a 55 year old to £2,216 pa for a 75 year old.

Annuity rate prospects for 2023

The majority of the gains have already been added by the providers as annuity rates increased 42% on average since last year whereas 15-year gilt yields are higher by 228 basis points or 28.8%.

This suggests providers have already priced-in a further rise in base rates for 2023 so annuity rates are likely to fall or rise slightly until further progress is made by gilt yields.

The Bank of England stated at the December 2022 meeting they expected inflation to remain high until the summer 2023 and then reduce substantially thereafter. If this is the case gilt yields will fall before this time followed by annuity rates.

Gilt yields reduced to 3.74% since the start of January 2023 as investors expect the Federal Reserve to be less hawkish after lower CPI inflation in the US falling from 7.1% to 6.5%.

Time is therefore limited to secure these high guaranteed income levels for annuities.

|