|

5 September 2019 last updated |

|

| UK annuity rates fall 12% for the year as gilt yields reach all time low |

|

| |

Annuity rates reduce over -12% as gilt yields fall to a record low of 0.566% on 3 September 2019. |

|

|

|

|

|

Annuity rates have reduced by -12.69% during 2019 as the 15-year gilt yields fall to a record low level of 0.566% on 3 September.

The 15-year gilt yields have decreased 72 basis points from 1.43% in January to 0.71% by the end of August. Providers have reduced annuity rates with our benchmark example for a 65 year old lower by 12.69% for the year.

Gilt yields reached a record low level of 0.566% on 3 September with a combination of factors. The continuing trade tensions between the US and China with President Trump to apply tariffs on the all remaining Chinese imports has sent investors to the safety of government bonds and gilts.

In the UK Boris Johnson extending the suspension of Parliament until 14 October 2019 has added to the uncertainty as it increases the chance of the UK leaving the EU without a trade deal.

| |

Annuity rates and gilt yields |

|

| |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

| Rate |

£5,487 |

£5,456 |

£5,361 |

£5,249 |

£5,205 |

£5,053 |

£4,864 |

| Yield |

1.61% |

1.33% |

1.49% |

1.21% |

1.18% |

0.98% |

0.71% |

|

Changes in the table are based on our benchmark example of a person aged 65 year old with a £100,000 fund in January, they could purchase an annuity on a single life, level basis with income of £5,571 pa. This has reduced by -£707 pa to the end of August with an income of £4,864 pa.

In terms of total income during their life, the Office of National Statistics (ONS) would expect a male to live for 18.5 years and he will have -£13,079 less over his lifetime. For a female she can expected to live for 20.9 years decreasing her lifetime income by -£14,776.

|

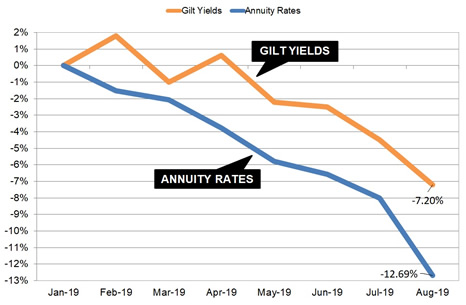

| Fig 1: Chart comparing standard annuity rates and 15-year gilt yields |

The chart shows annuity rates for 2019 are down -12.69% for the year so far compared to the 15-year gilt yields that are lower by 72 Basis points or -7.20%.

Annuity rates are based on the movement of 15-year gilt yields and in the long term you would expect providers to correct the difference by raising annuities by about 5.49%. In the short term standard annuities could increase by 1.10% and smoker and enhanced rates by 0.20%.

There is significant variation in the fall of rates depending on age and type of annuity purchased. The biggest falls are for those aged 60 buying a standard annuity on a 50% joint life with 3% escalation reducing by -22.12% this year. Standard 50% Joint life rates with 3% escalation have reduced in the range of -14% to -22% whereas smoker joint life rates have reduced in the range of -11% to -17%.

For single life annuities, rates for standard life on a level basis have a range of of -9% to -15% whereas with 3% escalation added the reductions are greater with a range of of -11% to -19%.

There is a good chance that a resolution of the US-China trade tariffs and Brexit would see gilt yields rise quickly and a recovery in annuity rates. Providers reduced rates aggressively ahead of the fall in yields so may be cautious raising rates too quickly.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|