|

| 24 January 2014 last updated |

|

| UK annuity income is 2.3% lower as FTSE-100 index falls on currency fears |

|

Annuity income in the UK for people that remain invested until they take their annuity has taken a hit as world markets fall with investor fears over currency liquidity sending the FTSE-100 index 163 points lower in the last few days.

The FTSE-100 index is 2.3% or 163 points lower in the last few days falling to 6,664 with the US Dow Jones 3.1% or 506 points lower at 15,879.

A fall in equities will directly impact the pension funds of people retiring and for those with a portfolio tracking the FTSE-100 index their fund will fall in value and the pension annuity they can purchase will also be lower.

The currency problem started in emerging market countries with a combination of political and corruption scandals coupled with lower liquidity as the US Federal Reserve reduces their stimulus package.

In addition providers have been reducing annuity rates resulting in a combination of falls.

|

|

|

| |

The FTSE-100 index falls reduce annuity income after emerging market currency fears |

|

|

|

| |

|

Annuity income 3.9% lower as rates and equities fall

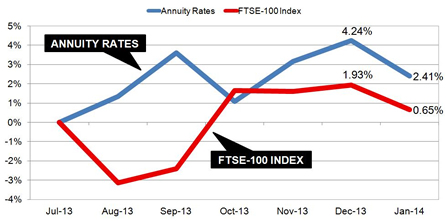

Earlier in the week Legal & General reduced their annuity rates by up to 2% and coupled with the 2.3% fall in equities has resulted in significantly lower income for people retiring now and buying an annuity. The chart below shows how annuity rates and equities have changed since July 2008.

|

| Fig 1: Chart comparing annuity rates and FTSE-100 index |

The chart shows how UK annuities and the FTSE-100 index have changed in the last six months and both had reached a high by the end of December, only to fall in January.

Our benchmark example for a person aged 65 with a fund of £100,000 could have purchased a single life, level annuity with an income of £6,184 pa a few days ago. The pension fund has now has reduced to £97,626 and annuity rates are lower with a rate of 6.087% resulting in an income of £5,942 pa or a fall of £242 pa or 3.91%.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £4,186 less over his lifetime. For a female she can expected to live for 20.4 years decreasing her income by £4,936.

Market volatility expected with poor liquidity

A study by the International Monetary Fund (IMF) shows the effect of Quantitative Easing (QE) by the US Federal Reserve has resulted in a $470 billion flow of funds from bonds to emerging markets.

Emerging markets have benefited significantly from the liquidity with higher grow than developed countries in the past year. However, the Fed are now tapering the stimulus reducing this from $85 billion per month to $75 billion in December and they could reduce this further in February.

Countries such as Brazil have seen their currency fall 20% against the dollar this year, South Africa down 30% in the last year, Turkey is at a record low against the dollar and Argentina's currency fell 12% on Thursday alone. The slowdown in growth from China may also be affecting liquidity as demand for raw materials from emerging markets slows.

As investors seek safe havens such as US Treasury notes and UK government gilts the 15-year gilt yields have reduced 9 basis points to 3.20%. It is likely that people retiring will experience volatility in terms of their pension fund and annuity rates in the next month. To avoid volatility people should convert equities to safer money market funds before buying their annuity to avoid the risk of a sudden fall in their pension fund.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|