|

3 April 2018 last updated |

|

| UK annuities risk fall after Trump trade tariffs on Chinese imports |

|

UK annuities may fall with fear of economic uncertainty after Trump unveils $50 billion of trade tariffs on Chinese imports sending stocks lower and investors seeking safe havens of government bonds and gilts.

President Donald Trump unveiled $50 billion of trade tariffs on Chinese imports due to the long term unfair trade practices of China.

It has signaled the possibility of a trade war between the US and China and investors fear the economic uncertainty sending equity markets lower and the 15-year gilt yields are down 17 basis points at 1.58%.

Annuity rates are mainly based on gilt yields and we would expect to see providers reduce rates by 1.7% at some point in the future.

The trade tariffs are to punish China for taking US intellectual property at the expense of American companies with 1,300 products are expected to

be targeted.

China has announced a 25% levy on $3 billion of US products imported to China escalating the rise of a trade war.

|

|

|

| |

Donald Trump $50 billion trade tariffs send gilt yields lower as investors seek safe havens |

|

|

|

| |

|

Annuity rates resisting lower yields

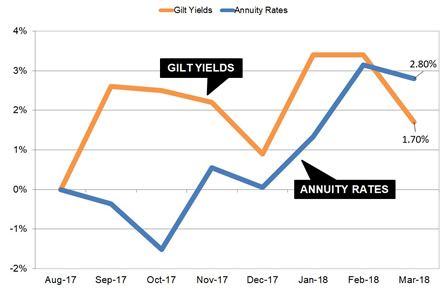

The 15-year gilt yields have reduced by 17 basis points to 1.58% in March down from a high for the year of 1.89% reached a month earlier with an expectation of higher US interest rates.

|

| Fig 1: Chart comparing standard annuity rates and 15-year gilt yields |

Providers have resisted decreasing pension annuities and since August 2017 are higher by 2.80% compared to gilt yields up 1.70% over the same period.

Our benchmark example reached a two year high last month (see table above and chart below) which is based on a 65 year old buying a single life, level annuity with a fund of £100,000.

| |

Standard annuity rates and gilt yields |

|

| |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

| Rate |

£5,473 |

£5,390 |

£5,503 |

£5,476 |

£5,546 |

£5,645 |

£5,626 |

| Yield |

1.34% |

1.66% |

1.63% |

1.50% |

1.75% |

1.75% |

1.58% |

|

Annuities reached an all time low reached in August 2016 of £4,696 pa several months after the Brexit vote as investors sought the safety of government bonds and gilts.

Rates have increased to £5,626 pa as there is an expectation of higher interest rates in the UK and US during 2018 and possibly the reason why providers, such as Aviva, Just, Canada Life and Legal & General are buoyant about keeping annuity income high.

For our benchmark example income has increased by £930 pa since August 2016. In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 18.5 years and he will have £17,205 less over his lifetime. For a female she can expected to live for 20.9 years decreasing her lifetime income by £19,437.

The possibility of a trade war between the US and China would have a negative impact on yields and may offset the positive drive of higher interest rates. The White House has claimed 's trade surplus with the US has cost America two million jobs.

Even so China has responded to Donald Trump with retaliatory tariffs of up to 25% on the $3 billion of food imports from the US including dried fruits, frozen pork and wine and the Dow Jones index has reduced by 500 points in response.

Annuities are resisting gilt yield uncertainty in the short term and further interest rate rises are expected which will help to keep yields at a higher level.

There may be further falls in equities and gilt yields in the short term which could see lower annuity rates.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|