|

22 March 2021 last updated |

|

| Pension annuities rise 3.2pc as investors sell gilt and bonds |

|

| |

Gilt yields increased by 60 basis last month and annuity rates could increase a further 2.75% |

|

|

|

|

|

Pension annuities increased by 3.2% responding strongly to 15- year gilt yields currently at 1.21% as investors sell gilt and bonds fearing higher inflation as economies recover from the pandemic.

Providers have increased our benchmark annuity rate for a 65 year old investing £100,000 for a single life, monthly advanced and level basis by £153 pa from £4,786 pa to £4,939 pa.

This means annuities could rise further by another 2.75% if gilt yields remain at current levels. The 15-year gilt yields have increased significantly from 0.54% at the beginning of February 2021 to a high of 1.24% on 18 March a rise of 70 basis in just over six weeks.

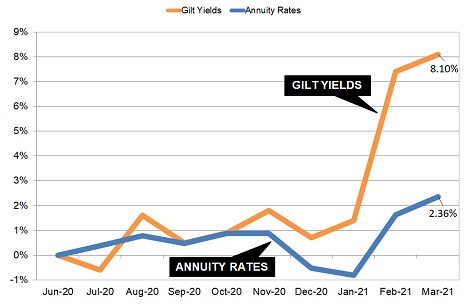

Annuity rates are mainly based on the 15-year gilt yields as providers will increase rates to reflect the current market conditions as are shown in the chart below.

|

Fig 1: Chart comparing standard annuity rates and 15-year gilt yields

|

Investors have been concerned with the prospect of higher inflation in the future as the global economy recovers from the pandemic and people return to spending. The price of gilts reach a high in March 2020 when yields reduced as low as 0.16% before returning to about 0.50% for much of last year.

Inflation increases the yield on other investment types and investors looking for a better return are rotating away from gilts. There is also the fear of a fall in gilt values although gilts and bonds are seen as a safe haven in a volatile global economy and are likely to return.

Find related news here:

Annuities set to rise 3pc as yields boosted by higher inflation forecast

Annuity rates higher as investors more optimistic for the economy

The chart is based on our benchmark example of a person aged 65 year old with a £100,000 fund. In January 2020 retirement income recorded the second lowest month ever of £4,786 pa for a single life, level basis for an annuity. This has increased 3.2% or £153 pa to £4,939 pa, the highest since February 2020 just before the covid-19 lockdown.

In terms of total income during their life, the Office of National Statistics (ONS) would expect a male to live for 18.5 years and he will have £2,830 more over his lifetime. For a female she can expected to live for 20.9 years increasing her lifetime income by £3,197.

There does appear more room for providers to increase pension annuity rates over the next few months by a further 2.75% if gilt yields remain at current levels of 1.21%.

Compared to June 2020 last year, 15-year gilt yields have increased 8.10% whereas annuity rates are up by only 2.36%. This suggests providers have scope for a rise of 5.74%, however, it is likely yields will fall back and adjustments made in the short term.

The direction for gilts and hence annuities, would depend on investor expectation of inflation going forward, the speed of the vaccination around the world and the actions of central banks, such as the Federal Reserve and the Bank of England, regarding raising base rates.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|