|

23 April 2015 last updated

|

|

| Annuity rates down 10% since pension rule changes announced |

|

Annuity rates have reduced by 10% across the board since George Osborne announced radical changes to UK pensions allowing people to take their fund as a cash lump sum rather than buy an annuity.

New pension rules started on 6 April allowing people complete freedom with their pension fund and to take this as a lump sum less tax at their marginal rate.

Previously only two options were possible. Firstly to take a 25% tax free lump sum with the balance being used to buy an annuity providing a guaranteed income for their lifetime. If they were married they could also include a spouse's income for their lifetime as well.

Secondly for those with larger funds they could select the higher risk pension drawdown investing their money in equity funds and drawing an income.

Annuity rates increased slightly after the Budget in 2014 before drifting lower to their current level 10% lower across the board, even though many expected more competition to increase rates.

|

|

|

| |

Standard annuity rates are lower by 10% in the last year reducing income for people retiring |

|

|

|

| |

|

Gilt yields drive annuity rates lower

People can now have access to their whole fund, taking their 25% tax free lump sum with the balance as a cash sum taxed at their marginal rate.

The fund can be used for any purpose such as buying a buy-to-let property, a cruise, new car, leaving the fund in flexi-access drawdown

or even buying an annuity.

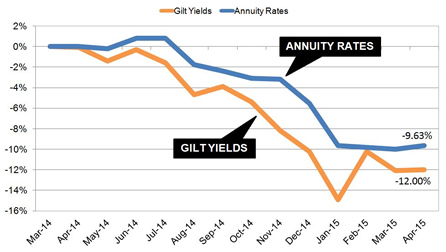

However, annuity rates are based mainly on the 15-year gilt yields which have reduced by 12.0% since March 2014 driving annuities lower.

|

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows our benchmark example for a person aged 65 with a fund of £100,000 could have purchased a single life, level annuity. Annuity rates improved slightly last summer before following gilt yields down to their current low level. The all time low for the benchmark was attained in January 2013 when the benchmark fell to £5,373 pa.

The benchmark is lower by 9.63% starting in March 2014 at

£6,093 pa and reducing by £587 pa to £5,506 pa. In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £10,155 less over his lifetime. For a female she can expected to live for 20.4 years decreasing her income by £11,974.

Enhanced annuities now 18% lower

The biggest fall for standard annuities is for 50% joint life, 3% escalation for a person aged 70 reducing by 11.90% followed by a single life, level income for a person aged 60 reducing by 11.32%.

For smoker and enhanced annuity rates the decrease is even greater. A single life, level income for a person aged 55 the reduction is 18.69% with falls of 12% to 15% applying to both single and joint life rates for people aged 55 to 65.

The significant falls are unlikely to reverse any time soon as gilt yields have been influenced by the European Central Bank (ECB) quantitative easing measures and low interest rates in the UK, US and Europe.

Many people a year ago would have delayed making a decision about buying an annuity even though now this would be their preferred route. Unfortunately not only have they lost one years income, they have also lost a large amount of future income with the lower rates.

Alternatives to annuities

The new pension rules have given people the opportunity to consider alternatives to the lifetime annuity by using flexible income plans.

A fixed term annuity offers a low risk route allowing you to select an income and term until annuities can recover. At the end of the term you would receive a guaranteed maturity amount and can consider all options again such as an annuity from any provider, flexi-access drawdown, taking the fund as cash or any other option available at that time.

An alternative would be flexi-access drawdown which changes your pension into a type of pensions savings account allowing you to take your tax free lump sum now and leave the remaining fund invested, take an income, a lump sum or even contribute to the fund.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,654 |

£6,281 |

|

|

| |

60 |

£7,014 |

£6,666 |

|

|

| |

65 |

£7,652 |

£7,219 |

|

|

| |

70 |

£8,619 |

£7,918 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|