|

| 4 February 2026 last updated |

|

Trump tariff threats on Europe about Greenland sends gilt yields higher

|

| Standard rates: |

|

|

0.12% |

|

| Enhanced rates: |

|

|

0.17% |

|

| Gilt yields: |

|

|

6 basis point |

|

|

|

|

| |

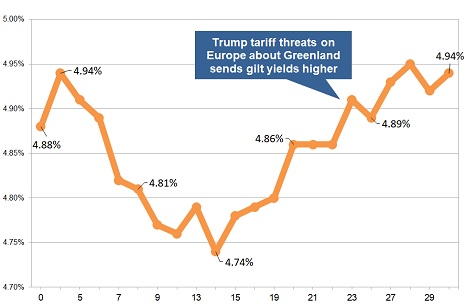

| 15-year gilt yields chart - Based on figures for January 2026 |

|

Annuity Rates UK - January 2026 review

The 15-year gilt yields reduced to 4.74% the lowest point for a year before rising +20 basis points to 4.94% by the end of the month.

US President Donald Trump's demand to acquire Greenland for security reasons was opposed by Denmark and European allies leading to the threat of 25% tariffs from 1 June 2026.

Trump said he intended to apply a 10%

tariff from 1 February on all goods sent to the United States from Denmark, UK, France, Germany, Norway, Sweden, Finland and Netherlands.

Denmark's pension fund indicated it would sell US Treasuries with investors selling bonds, sending yields of all government debt higher during the month.

Gilt yields remain high as the latest US economic data for producer price index (PPI) increased from 0.1% to 0.5% per month. Higher prices for finished goods and services are passed on to consumers increasing US inflation. This makes it less likely the Federal Reserve will reduce interest rates sending yields on bonds and gilts higher.

In the UK consumer price index (CPI) released by the ONS in January 2026 increased to 3.4% suggesting the Bank of England will delay reducing base rates pressuring gilt yields to remain higher for longer.

As annuity rates are primarily based on 15-year gilt yields, the gradual rise of yields to 4.94% means providers have more opportunity to increase annuity rates going forward.

Find related news here:

Annuities unchanged after lower base rates with yields in narrow range

Annuities could rise even after BoE lowers interest rates to 3.75pc

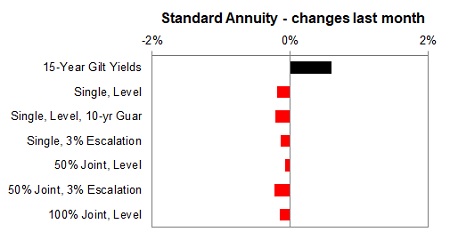

Providers of standard annuities decreased rates by an average of -0.17% this month and we would expect rates to rise by +0.77% in the short term if yields remain at current levels.

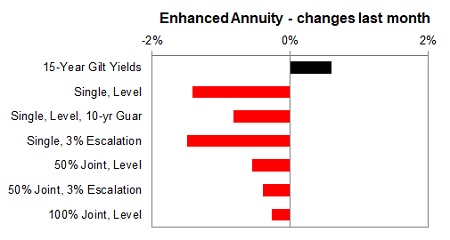

For smoker and enhanced annuity providers decreased their rates by an average of -0.98% and we would expect rates to rise by +1.58% in the short term if yields remain at current levels.

Fig 1 below shows the annuity rates changes for the whole market and the proportion that have either increased, decreased or or did not change. It also shows the range of the changes of the annuity rates over the last month:

|

| |

Fig 1: Annuity rate changes for the whole market |

|

For the month 22% of annuity rates increased by up to +1.8% with 16% remaining unchanged and 62% decreasing by as much as -1.7%.

What happened to standard rates

Below shows a fund of £100,000 with the change in standard annuity rates for single and joint pensioners from age 55 to 75 with different annuity options such as level or escalating over 1 month compared to gilt yields:

|

| Fig 2: Change in standard rates last month compared to gilt yields |

What happened to enhanced rates

Lifestyle smoker and enhanced annuities have decreased significantly across the board for all types of annuities and ages.

|

| Fig 3: Change in enhanced rates last month compared to gilt yields |

For the latest updates see Annuity Rates Review.

Changes to the 15-year gilt yields

The yields change for the month from 4.88% to 4.94% or +6 basis points. Table 1 below shows the daily 15-year gilt yields and the increase or decrease from the previous day's close:

| 15-Year Gilt Yields - January 2026 |

| Day |

Rate (%) |

Change (bp*) |

| 2 |

4.94 |

+6 |

| 5 |

4.91 |

-3 |

| 6 |

4.89 |

-2 |

| 7 |

4.82 |

-7 |

| 8 |

4.81 |

-1 |

| 9 |

4.77 |

-4 |

| 12 |

4.76 |

-1 |

| 13 |

4.79 |

+3 |

| 14 |

4.74 |

-5 |

| 15 |

4.78 |

+4 |

| 16 |

4.79 |

+1 |

| 19 |

4.80 |

+1 |

| 20 |

4.86 |

+6 |

| 21 |

4.86 |

0 |

| 22 |

4.86 |

0 |

| 23 |

4.91 |

+5 |

| 26 |

4.89 |

-2 |

| 27 |

4.93 |

+4 |

| 28 |

4.95 |

+2 |

| 29 |

4.92 |

-3 |

| 30 |

4.94 |

+2 |

|

| |

Table 1: Daily 15-year gilt yields and changes

* bp - basis points |

|

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,506 |

£6,169 |

|

|

| |

60 |

£6,850 |

£6,591 |

|

|

| |

65 |

£7,658 |

£7,195 |

|

|

| |

70 |

£8,410 |

£7,913 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|