|

| 3 June 2013 last updated |

|

| Impaired annuity rates up 2.4% higher from Liverpool Victoria |

|

Impaired annuity rates have been increased as much as 2.4% from Liverpool Victoria after significant rises in gilt yields give providers greater scope for competition by improving the rates offered to people retiring.

Liverpool Victoria is one of the leading providers of enhanced and impaired annuities and they have followed Just retirement with higher rates across the board of 1.0% and up to 2.4% for certain medical conditions.

Apart from enhanced and impaired annuities Aviva have improved their standard rates by 0.6% although providers in this market have been reluctant to improve their rates.

Annuity rates are based on the 15-year gilt yields and these increased by 35 basis points.

As a general rule this would mean annuities rising by 3.5% with the impaired providers aggressively improving rates. See the latest annuity rates review for more details of changes last month. |

|

|

| |

As gilt yields rise impaired annuity providers are increasing rates to the benefit of people retiring |

|

|

|

| |

|

Impaired annuities can rise further

From our review last month it is clear in the short term impaired annuity rates can increase. Enhanced annuities were higher by 1.54% and with gilt yields increasing by 35 basis points means there is scope for further rises of 1.96% on average.

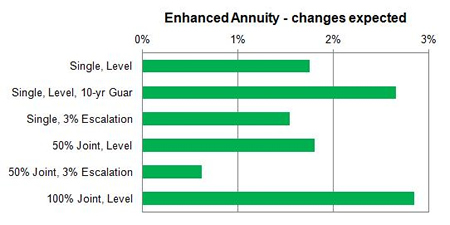

The following

shows how the changes expected to vary for different types of annuity features.

|

| Fig 1: Changes expected for impaired annuities with different features |

The largest increase expected is from 100% joint life level annuities with an increase expected of 2.84% with single life, level with a 10 year guaranteed period close behind with 2.66%. The annuity feature with the least improvement expected is 50% joint life with 3% escalation which will improve by only 0.62% mainly because last month this feature was improved the most and has little margin remaining for increases.

For example, our benchmark for a person aged 65 suffering from high blood pressure and high Cholesterol and diabetes with a fund of £100,000 buying a single life, level pension annuity would receive £6,617 pa and this has been increased by Liverpool Victoria by £116 pa to £6,733 pa.

Uncertain economic data unsettling markets

Investor confidence remains high as funds have moved away from safe havens such as US Treasury notes and UK government bonds and gilts to other higher yielding investments. However, equity markets have been falling since the FTSE-100 index reached a high of 6,840 on 22 May and is now at 6,525, representing a 4.6% reduction.

For those that remain invested and track the FTSE-100 index before buying their impaired annuity, this will reduce their pension funds

by about 4.6%. Using our benchmark example above it would result in their expected income reducing to £6,423 pa countering the gains as a result of rising gilt yields.

In the US manufacturing has contracted with the Institute for Supply Management (ISM) index falling to 49, below the 50 level indicating contraction, down from the previous month of 50.7. This is the result of US budget spending cuts impacting on the economy which are set to continue. China has also experienced a similar contraction as the US with output falling below the 50 level.

If confidence falls investors may look for safe havens again and this would lower the 15-year gilt yields. Enhanced and impaired annuities are sensitive to changes in yields and providers would reduce their rates quickly if the concern over the US continues.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|