|

17 May 2021 last updated |

|

| Retirement income recovers 30pc as UK eases lockdown measures |

|

| |

Retirement income is 30.5% higher as equity markets recover and investors expect higher inflation. |

|

|

|

|

|

Income at retirement has increased 30.5% as the UK eases lockdown measures with a recovery in equity markets and higher gilt yields due to inflation fears.

Our benchmark example shows income from a pension fund has recovered to £6,546 pa up 30.5% or £1,530 pa from a record low of £5,016 pa in October 2020.

The figures for the benchmark are based on a 65 year old in good health buying a lifetime

annuity with £100,000 on a single life and level basis.

Due to a combination of annuity rate increasing and a strong recovery in equity markets, people that remain invested up to retirement are now in a stronger position to secure income.

Find related news here:

Gilt yields rise record amount of 60 basis points on inflation fears

Retirement income bounces back with strong stock market rise

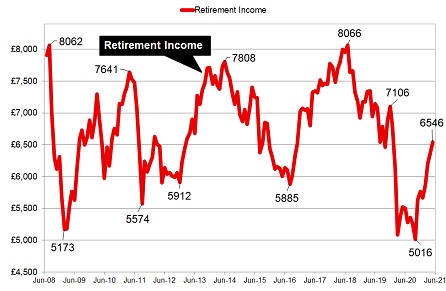

This chart shows how retirement income has changed over time starting in July 2008 with a fund of £100,000. It assumes a portfolio tracks the FTSE-100 index and shows the buying power of the fund over time. With rises and falls in fund value and annuity rates, this is the income that could be generated.

|

| |

Benchmark annuity rates and FTSE-100 index |

|

| |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

| FTSE |

6,266 |

6,502 |

6,407 |

6,483 |

6,713 |

6,959 |

7,043 |

| Rate |

£4,867 |

£4,800 |

£4,786 |

£4,903 |

£4,999 |

£4,965 |

£5,029 |

|

Fig 1: Chart and table comparing retirement income from 2008 to 2021 |

The chart shows how the buying power of £100,000 has changed over time starting in July 2008 at £7,908 pa. With rising and falling equities and gilt yields this figure was not exceeded until a decade later in July 2018 with £8,066 pa.

In real terms taking account of inflation during this period the buying power would not keep up with the cost of living and demonstrates the challenge of producing income at retirement.

After the 15-year gilt yields reached an all time low of 0.162% in March 2020 our benchmark example annuity rates reduced from £5,027 pa in February 2020 to £4,853 pa the next month.

During the pandemic lockdown both gilt yields and annuity rates remained at a consistent level until February 2021 as investors fear of rising global inflation resulted in selling gilts.

Yields increased from 0.54% at the start of the year to end February up 60 basis points at 1.14%. Providers have been slow to raise annuity rates although these are now back at the pre-pandemic levels of £5,029 pa.

Equity markets have made a strong recovery since the first lockdown in 2020 with the Dow Jones index rising 79.3% from a low of 19,173 in March last year to 34,382. The FTSE-100 index has performed well up 40.8% from the low of 4,999 and now at 7,043.

The FTSE-100 index remains -9.0% down on the February 2020 high of 7,674 as investors have been cautious following Brexit and data suggesting higher inflation. In the US consumer prices are higher by 4.2% for 12 months to April 2021 up from 2.6% for the same period to March.

Pension funds and flexi-access drawdown plans should benefit from economic recovery in the second half of the year as long as lockdowns do not return to the same degree experienced in the first quarter of the year. Annuity rates may get a boost from rising gilt yields as inflation fears continue with an economic growth.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|