|

12 April 2019 last updated |

|

| Enhanced annuity rates down over 3% as investors seek safe havens |

|

| |

Providers reduce enhanced annuity rates by -3.31% following fall in 15-year gilt yields. |

|

|

|

|

|

Enhanced annuity rates have been reduced by -3.31% by providers as gilt yields fall 28 basis points after investors seek the safety of bonds and gilts with uncertainty over Brexit.

Providers of enhanced annuities have reduced rates by an average of -3.31% for the month of March in 2019 after a period of over a year maintaining income levels above expected levels.

|

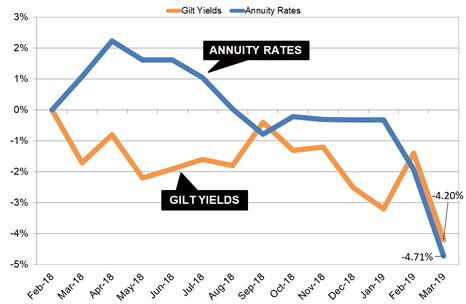

| Fig 1: Chart comparing standard annuity rates and 15-year gilt yields |

The above chat shows since February 2018 enhanced annuity rates have maintained income levels where the 15-year gilt yields moved lower during this period.

In the last two months providers have reduced rates by -4.41%

with the majority of the decrease in March. Since February last year enhanced annuities have reduced -4.71% with gilt yields lower by -4.20%.

| |

Enhanced annuity rates and gilt yields |

|

| |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

| Rate |

£5,957 |

£5,991 |

£5,986 |

£5,985 |

£5,985 |

£5,889 |

£5,721 |

| Yield |

1.71% |

1.62% |

1.63% |

1.50% |

1.43% |

1.61% |

1.33% |

|

The above table shows that for our benchmark example of a 65 year old with £100,000 an annuity on a single life, level basis would provide an income of £5,721 pa in March. This compares to a stable period back to February 2018 when the income was £6,004 pa with little change until January 2019.

Annuities for enhanced and smoker rates with the largest reduction was -5.0% for those aged 55 purchasing a single life, escalating annuity. Other categories reducing 4.2% was for single life, level annuity for those aged 55 and 70 to 75.

Since reaching a low of 1.28% on 26 March the 15-year gilt yields have recovered in April with Brexit delayed until later in the year and improved economic data the US, China and the Eurozone.

The better than expected data means the risk of a global economic slowdown is less likely and investors have a greater appetite for risk in equities with the FTSE-100 index improving to 7,451.

An improvement in gilt yields to 1.51% on 12 April combined with rising equity values would benefit people retiring where they remain invested before buying their annuity, especially if providers revise annuity rates upwards later this month.

|

| |

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|