|

13 March 2020 last updated |

|

| Retirement income at decade low with panic selling on equity markets |

|

| |

Income from invested pensions reduces by 31.5% and is lower than the 2008 Financial Crisis |

|

|

|

|

|

Retirement income is lower than after the Financial Crisis of 2008 due to plunging equity markets down 30% this year and lower annuity rates with fears over coronavirus.

Income from our benchmark example was at 85% of an all time high on 21 February 2020 and in three weeks has reached a decade low with income 31.5% lower since the start of the year for people retiring.

Find related news here:

Gilt yields fall as coronavirus threatens slowdown for global growth

Pension annuities risk as oil price fall sends yields to all time lows

Rapid spread of the coronavirus has seen cases rise to over 150,000 around the world with plunging equity markets and the fear of significant slowdown in economic growth or even recession.

On Thursday 12 March US equity markets suffered the worst falls since October 1987 and the FTSE-100 index has reduced 2,176 points or -30.9% since the start of the year when the index was at 7,542.

This has had immediate impact for people retiring with pension funds remaining in equities with significant falls in values and the prospect of lower pension income for their lifetime.

|

| |

Benchmark annuity rates and FTSE-100 index |

|

| |

Sep |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

| FTSE |

7,408 |

7,248 |

7,346 |

7,542 |

7,286 |

6,580 |

5,366 |

| Rate |

£4,956 |

£4,827 |

£5,065 |

£5,098 |

£5,032 |

£5,027 |

£4,907 |

|

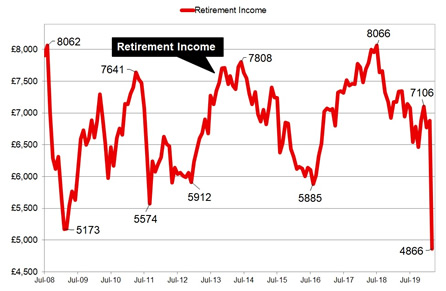

Fig 1: Chart and table comparing retirement income from 2008 to 2020 |

The above table and index chart of retirement income is based on a 65 year old with £100,000 buying a single life, level annuity. The chart assumes the fund is valued at £100,000 in July 2008 and invested in a fund that tracks the FTSE-100 index.

In July 2008 a fund of £100,000 could provide an annuity income of £7,908 pa and this reached a high of of £8,066 in August 2018. At the start of the year the income was £7,106 pa and by 21 February 2020 it was £6,878 pa.

Since the equity markets reaction to coronavirus retirement income has reduced to £4,866 pa, the lowest point in over a decade and lower than the level reached in the financial crisis of 2008.

Annuity rates are based mainly on the 15-year gilt yields which collapsed to an all time low of 0.162% on 9 March 2020. This was a fall of 91 basis points for the year and yields have since recovered to 0.65% on 13 March.

Providers have adjusted annuity rates downward by about -3.5% for the month which does not reflect the level of volatility and are being cautious in these volatile times.

US stocks soar after Trump speech

On Friday 13 March President Trump declared a national emergency to counter the rapid rise in coronavirus cases in the US and reduce the damage to the US economy.

The measures include significantly increasing testing with 1.4 million available in one week and 5 million next month, adding Covid-19 drive through testing sites, expanding the treatment for patients and $50 billion of funds.

Other measures are to increase the national reserves of oil buying 92 million barrels after the crash in prices and waive interest for people with coronavirus that hold student loans. Another package could be delaying the tax season for those affected providing another $200 billion of liquidity.

This was

welcomed by markets with the Dow Jones up 1,985 points or 9.36% the biggest one-day gain since 2008.

This may result in a rise of global equity markets as other countries aim to have a coordinated response with measures from governments and central banks to counter coronavirus and lesson the impact to the economy.

High levels of volatility for equity markets and gilt yields are likely to continue impacting people retiring with invested pension funds. An option to consider flexi-access drawdown may help to access some tax free lump sum and income in the short term delaying the need to commit the full fund to buying an annuity when retirement income is at such a low level.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,361 |

£5,898 |

|

|

| |

60 |

£6,842 |

£6,244 |

|

|

| |

65 |

£7,474 |

£6,843 |

|

|

| |

70 |

£8,405 |

£7,660 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|