|

15 January 2015 last updated

|

|

| Annuity rates fall 4.2% as 15-year gilt yields reach an all time low |

|

Annuity rates have reduced 4.2% in the past six weeks as the 15-year gilt yields plummet to an all time low of 1.87% with continued uncertainty in global economies sending investors to find safe havens such as government bonds and gilts.

Annuity rates are mainly based on the 15-year gilt yields. Since September last year the yields were at 2.78% reducing to 1.87% in January 2015 following global economic uncertainty.

This represents a 91 basis point fall and as a general rule this would result in a 9.1% decrease in annuity rates.

Over this period of time pension annuities have reduced by only 5.0% of which 4.2% has been in the last six weeks from providers such as Legal & General, Canada Life and Hodge Life.

Already this year yields have reduced from 2.15% to 1.87% suggesting pressure is increasing on rates creating downward pressure on providers to reduce rates further if yields do not recover.

|

|

|

| |

Gilt yields reach a low of 1.87% sending annuity rates lower with continued pressure on providers |

|

|

|

| |

|

Yields continue to fall to all time lows

Investors are seeking safe havens such as government bonds and gilts following global economic uncertainty. In particular deflation fears in the Eurozone signals a new quantitative easing programme from the European Central Bank (ECB).

Analysts are expecting a stimulus programme in the region of €2.3 trillion, more than double the level suggested by the ECB. This along with the uncertainty of rapidly falling oil prices has contributed to yields reaching their lowest ever levels.

|

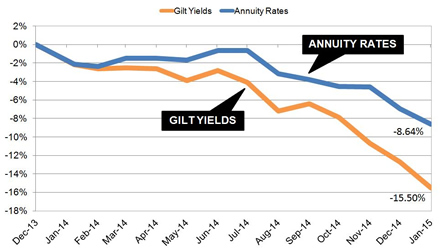

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart shows how the 15-year gilt yields have reduced and are now 15.5% lower than the high reached in December 2013 following the market's recovery. Over this time pension annuity rates have failed to keep pace and are lower by only 8.64%. If yields fail to recover and remain low, eventually providers will lower rate to match decrease.

In the last six weeks rates are lower by 4.2%. For our benchmark example for a person aged 65 with a fund of £100,000 could have purchased a single life, level annuity with an income of £5,900 pa and this has now reduced by £250 pa to £5,650 pa.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £4,325 less over his lifetime. For a female she can expected to live for 20.4 years decreasing her income by £5,100.

If rates were to match the fall in yields since December 2013, rates in our example would see income reducing from the high of £6,184 pa to a new all time low of £5,225 pa.

Alternatives to an annuity

If annuity rates continue to fall to new all time low levels there are alternatives. It is possible to take an income and delay buying an annuity using a flexible income plans.

For the greatest freedom flexible drawdown offers the greatest flexibility where an income or cash sums can be taken at any time and is accessible on a regular or single payment basis. The fund can remain invested in protected funds that add interest daily produced a smoothed return over time.

As an alternative for a very low risk option a fixed term annuity can be taken for one year or more with an income selected by you and a guaranteed maturity amount at the end of the term. At the end of the term all open market options are available including an annuity from any provider, pension drawdown, taking the fund as cash or any other option available at that time.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|