|

6 February 2017 last updated |

|

| Annuity income increases up to 18% in five months since all time low |

|

Annuity income at retirement has recovered since reaching an all time low in August 2016 after the Brexit vote and is now up to 18% higher following a rise in gilt yields.

There has been a strong recovery in annuity rates since the EU Referendum when 15-year gilt yields reached an all time low in August 2016 of 0.90% rising 85 basis points to 1.75%.

Annuities are mainly based on the change in gilt yields and

an 85 basis point rise should result in an 8.5% rise in rates.

Annuity rates have increased by 18.6% for those aged 65 buying a single life, 3% escalating annuity and on average are 12.3% across the board for standard annuities.

Smoker and enhanced annuities are higher by a smaller amount of 8.5% over the same period with the highest rise is 12.5% for those aged 65 buying a single life, level and for those aged 60 buying a 50% joint life, level annuity.

Whereas enhanced rates have matched yields, standard rates have exceeded what we were expecting.

|

|

|

| |

There has been a 24..2% rise in annuity income those invested before buying their annuity |

|

|

|

| |

|

Strong rise in rates and equities

Where there is a combination of both annuity rates and equities rising, those people that remain invested before they buy an annuity can benefit significantly.

|

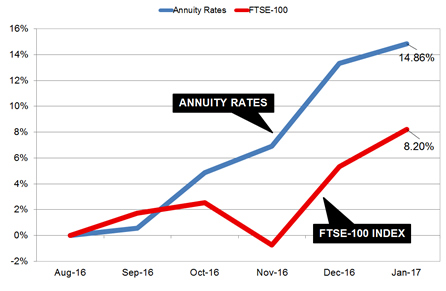

| Fig 1: Chart comparing annuity rates and FTSE-100 Index |

The above chart shows how the FTSE-100 Index and annuity rates for our benchmark example have increased since August 2016 after the EU Referendum.

Our benchmark example for a person aged 65 with £100,000 buying a single life, level annuity would receive £4,696 pa in August last year rising by 14.86% or £698 pa to £5,394 by the start of February.

For those that remain invested before buying their annuity, the combination of both rising rates and equities has resulted in a significant rise in annuity income.

A pension fund reflecting the FTSE-100 index would have increased by 8.2% since August 2016. For example, a fund value of £100,000 at this time would offer an income of £4,696 pa. The fund would now be £108,199 and with the rise in rates for our benchmark example the income from this fund would be £1,140 pa or 24.2% higher at £5,836 pa.

In terms of lifetime income, the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will have £19,836 more over his lifetime. For a female she can expected to live for 20.4 years increasing her income by £23,256.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|