|

29 April 2020 last updated |

|

| Annuities and equity markets rise after successful Covid-19 trials |

|

| |

Successful trial to treat Coivid-19 has seen the FTSE-100 index up 6.3% and higher annuity rates |

|

|

|

|

|

Equity markets around the world have increased on reports of a successful trial of an experimental drug produced by Gilead to treat Covid-19.

The FTSE-100 Index increases 6.3% during the week to end at 6,115 showing investors have more confidence of an economic recovery with a treatment for the Coronavirus (Covid-19).

Investors have been concerned about the spread of the Coronavirus with 3.2 million cases and over 228,000 deaths. The experimental drug remdesivir developed by Gilead is the first successful trial to treat severely ill patients suffering from Covid-19.

Find related news here:

Annuity rates could rise after volatile gilt yields impact by Coronavirus

Gilt yields fall as coronavirus threatens slowdown for global growth

Pension annuities risk as oil price fall sends yields to all time lows

Annuities have remained relatively stable since October 2019 considering the volatility to gilt yields caused by Brexit and then Coronavirus.

|

| |

FTSE-100 index and gilt yields |

|

| |

Oct |

Nov |

Dec |

Jan |

Feb |

Mar |

Apr |

| FTSE |

7,248 |

7,346 |

7,542 |

7,286 |

6,580 |

4,993 |

6,115 |

| Rates |

£4,827 |

£5,065 |

£5,098 |

£5,032 |

£5,027 |

£4,853 |

£4,926 |

|

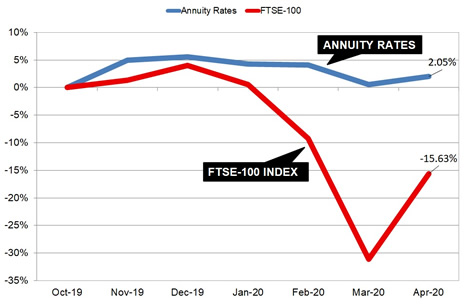

Fig 1: Chart and table comparing FTSE-100 Index and 15-year gilt yields |

The above chart and table shows the FTSE-100 index has increased 22% or 1,122 points since reaching a low of 4,993 on 23 March and is above 6,000 for the first time since global markets reacted to the spread of Coronavirus.

Compared to October 2019 the index is lower by -15.63% whereas annuity rates are higher by 2.05%. Annuities fell to an all time low in August 2016 following the result of the EU Referendum with our benchmark example of a person aged 65 years old with a £100,000 fund and annuity income of £4,696 pa.

Our benchmark annuity income increased to a recent high of £5,645 pa in February 2018 reducing slightly to £5,571 pa in January 2019.

With the uncertainty over Brexit last year rates fell to about the £5,000 pa level after July 2019. Rates have not been significantly impacted by the Coronavirus pandemic and are now at £4,926 pa.

The results from the Gilead experimental drug trials are encouraging and involved 1,063 patients with advanced stage of Covid-19. When compared to a placebo the remdesivir drug performed better with 31% of patients recovering faster. In addition the survival rate was also improved with 8% mortality for remdesivir compared to 11.6% for the placebo.

With many more laboratories researching treatments and vaccines it is likely there will be more successful trials in the future and this will help to restore investor confidence that the global economy can recover.

Equity markets could have further increases over the coming months with positive results from drugs trials and an improving global economy. Annuity rates and the 15-year gilt yields appear stable at current levels given the current uncertainty and our benchmark is likely to remain at the £5,000 pa level going forward.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|