|

5 June 2020 last updated |

|

| Annuities could rise as equity markets and gilt yields rebound |

|

| |

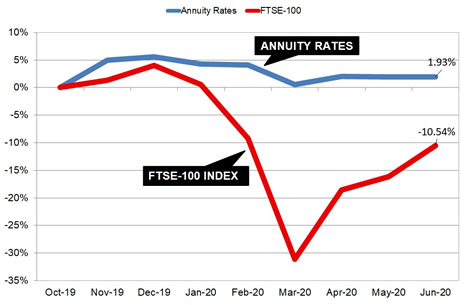

Annuity rates could rise 1.9% with higher gilt yields as US markets lead equities higher |

|

|

|

|

|

Strong rise in US equities with better than expected economic data and less impact from Covid-19 sends global markets and gilt yields higher.

The US Dow Jones Index is up 6.4% for the first week of June with the FTSE-100 Index increasing 318 points or 5.1% to 6,484. Since reaching a low of 4,993 on 23 March the index has increased 1,491 points or 29.8%.

Yields on bonds and gilts have increased with the 15-year gilt yields rising 19 basis points to 0.58%. As annuity rates are mainly based on these yields it suggests that providers may be able to increase pension annuities by about 1.9% at some point in the future if gilt yields remain at this level.

In the US the level of unemployment has reduced from 14.7% to 13.3% when analysts expected the level of unemployment to increase to 19%. In addition there is substantial fiscal and monetary stimulus available to support the economy when needed.

|

| |

FTSE-100 index and gilt yields |

|

| |

Dec |

Jan |

Feb |

Mar |

Apr |

May |

June |

| FTSE |

7,542 |

7,286 |

6,580 |

4,993 |

5,901 |

6,076 |

6,484 |

| Rates |

£5,098 |

£5,032 |

£5,027 |

£4,853 |

£4,926 |

£4,920 |

£4,920 |

|

Fig 1: Chart and table comparing FTSE-100 Index and 15-year gilt yields |

The above chart and table shows the rapid recovery in the FTSE-100 index after reducing to 4,993 following investor fear of the economic impact of Coronavirus.

Find related news here:

Equity markets rally on hopes for vaccine as yields lack direction

Annuity rates higher despite lower yields with global economic concerns

Equity markets surge 15% as US Senate agrees $2tn stimulus package

The combination of news from drugs researcher Moderna on 18 May of a positive outcome from the vaccine trial against Covid-19 and better than expected unemployment figures in the US has given investors more confidence that the economic outlook may not be as bleak as expected.

Rising equity markets is against a backdrop of demonstrations and protects around the would after the death of George Floyd

and continuing spread of Covid-19 in South America and Middle Asia.

During the Coronavirus pandemic annuity rates have remained surprisingly steady with our benchmark example of a 65 year old with £100,000 buying an annuity on a single life, level basis reducing from £5,032 pa in January to £4,853 pa in March.

The rate of £4,920 pa in June is actually 1.93% higher than the figure in October 2019 and for those invested in equities, your fund is likely to have recovered much of the losses sustained since March.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,361 |

£5,898 |

|

|

| |

60 |

£6,842 |

£6,244 |

|

|

| |

65 |

£7,474 |

£6,843 |

|

|

| |

70 |

£8,405 |

£7,660 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|