New product innovations from April 2015

Providers are already developing ideas for future retirement products combining a guaranteed annuity income while having an option to access capital using flexi-access drawdown. These will not be available until the new pension rules are given Royal Assent in 2015.

A lifetime pension annuity involves people buying an income and agreeing to give the capital away to an insurance company. By purchasing a lifetime annuity now people will give away the opportunity to have a product that offers a guaranteed income and access to capital.

There could be advantages for accessing capital from a pension fund such as a medical emergency such as an operation not covered by the NHS, to help children with a deposit on a property, a holiday or purchase a new car.

Fixed term plan will preserve your fund

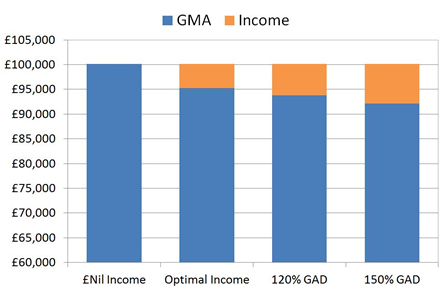

A fixed term plan is also known as a fixed term annuity. Based on an example of 60 year with a fund of £133,333.34, a tax free lump sum of £33,333.34 can be taken now leaving £100,000 for a one year fixed term plan.

The plan will provide a guaranteed maturity amount (GMA) at the end of the term of £100,111. This will be offered fully as a GMA if no income is taken or this fund less income and the residual amount as a GMA as the following charts shows.

|

| Fig 1: Fixed term plan guaranteed maturity amount and income options |

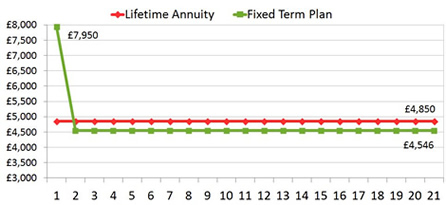

In our example an income can be taken from £Nil to a maximum of £7,950 pa called maximum 150% GAD and this has been increased in the Budget from the 120% level. The maximum income is 63.9% more than the lifetime annuity of £4,850 pa on a 100% joint life and level basis. The following chart shows how the income would change of a lifetime annuity was purchased in one years time.

|

| Fig 2: Chart comparing income from fixed term and annuity options |

The fixed term plan would remain ahead of the lifetime annuity in terms of cumulative income for 12 years. This assumes an annuity of £4,546 pa was purchased in one years time with the residual fund and there are no changes to annuity rates.

The Bank of England has indicated it will not rule out an interest rate rise from the current 0.5% level. City analysts are expecting a rise to 1.0% or even as high as 1.75% which would see annuity rates increase by between 5.0% to 12.5% by the end of 2015.

Personal tax of cash sums

At the end of the one year term there will be the option of taking the fund as a cash sum, a lifetime annuity, another fixed term plan with all or part of the fund or any other option available at that time from any provider.

The first £10,000 of income is the personal allowance and this is not taxed. The next £31,865 is at basic rate tax of 20%

and thereafter higher rate tax at 40% applies.

Most people would prefer to avoid paying higher rate tax which means to extract the full fund after April 2015 would require using a number of tax years. If your retirement income is more than £12,000 pa it would be possible to use a flexi-access drawdown and take more income from the fixed term plan than maximum 150% GAD.

As an example, of a person aged 60 has a fund of £50,000 after tax free cash and a pension income of £15,000 pa. An income of £26,865 pa could be taken from a one year fixed term leaving the remaining £23,135 to be taken as a lump sum in 2015.

With so much potential change of pension rules, improved products and higher annuity rates there are significant opportunities for people to have a short term plan and review later in 2015.

|