|

| 12 September 2013 last updated |

|

| Enhanced annuities rise 1.5% after strong gains in gilt yields |

|

Enhanced annuity providers have increased their annuity rates following a strong gains in the 15-year gilt yields after markets expect interest rates to rise sooner rather than later improving the level of income for people retiring.

Providers of enhanced annuities are very sensitive to changes in the 15-year gilt yields. Annuities are primarily based on this gilt and this month yields are 15 basis points higher.

As a guide a 15 basis point rise in yields would mean a 1.5% increase in annuity rates and providers have matched the change.

In particular Just Retirement has been leading the market with aggressive increases in their rates followed by Partnership with a 1.0% rise and Liverpool Victoria also improving their margins.

Competition has been increasing in the summer after a slow start to the year following high volumes of business running up to the EU Gender Directive that introduced Unisex pricing in December 2012.

|

|

|

| |

Enhanced annuity providers up rates by 1.5% to keep pace with rising gilt yields |

|

|

|

| |

|

Annuity income 12.5% higher this year

Standard annuity rates have also increased today with Aviva rates up by 1.3% after Legal & General made improvements last week as competition intensifies.

During the year rates have made good progress as our benchmark example has increased

12.55% in 2013 compared to gilt yields which are up 98 basis points. This pension annuity is based on a 65 year old with a fund of £100,000 purchasing a single life, level annuity payable monthly in advance with no guaranteed period and enhanced annuities have also increased a similar amount.

As an example, in December 2012 it was possible to buy an income of £5,425 pa and this has increased by £681 pa to £6,106 pa. Over a persons lifetime the Office of National Statistics (ONS) would expect a male to live for 17.3 years and he will receive an extra £11,781. For a female she can expected to live for 20.4 years increasing their income by £13,892 this month alone.

In addition equity markets are also up rising from 11.6% from 5,897 in December to 6,583 today. For those that remain invested with a fund that tracks the FTSE-100 index their fund would have increased from £100,000 to £111,600 and the income they could purchase with this larger fund would be £6,814 pa. This means their income would be 25.6% higher today when compared to buying an annuity at the beginning of the year.

Annuity rates still lower over the long term

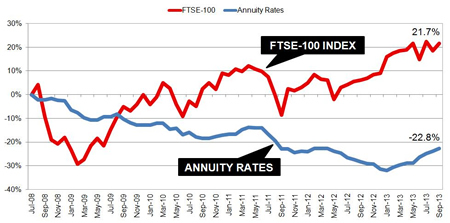

So far this year annuities are ahead of yields as we would expect a rise of 9.8% but annuity income is higher by 12.55%. Over the longer term this is not the case as the chart below shows.

|

| Fig 1: Chart comparing annuity rates and FTSE-100 index |

Although equity markets reached a low of 29.2% in January 2009 the FTSE-100 index is now 21.7% higher than it was in July 2008 as the financial crisis started. However annuity rates continued to fall to a low of 32.1% in January this year and remains 22.8% lower than July 2008 whereas gilt yields are now 15.4% lower. This would suggest providers have some way to go to catch up to yields over the long term even after improvements this year.

Enhanced annuities offer good value

People buying their annuity now should take full advantage of any medical conditions as this will improve the income they receive and make an annuity better value for money. An impaired annuity would take into account life expectancy which is reduced for serious conditions such as heart disease, diabetes and cancer offering up to 40% more income in many cases than the highest standard rates.

For lifestyle medical conditions such as high blood pressure, Cholesterol, smoking ten or more cigarettes per day or by being overweight an enhanced annuity can offer an 18% higher income.

It is also possible receive an income now and come back to the lifetime annuity at a later date. A fixed term annuity lets you select a term from three years or to a particular age such as 75 and receive an income.

At the end of the term you would receive a guaranteed maturity amount allowing you to buy using an open market option another fixed term plan, lifetime annuity or other pension available at that time. This would allow more time for annuities to improve and also any medical conditions that occur could also significantly increase the rate.

|

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£6,132 |

£5,784 |

|

|

| |

60 |

£6,532 |

£6,234 |

|

|

| |

65 |

£7,247 |

£6,808 |

|

|

| |

70 |

£8,170 |

£7,616 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|