|

26 May 2023 last updated |

|

| Annuities rise 4pc with soaring gilt yields due to high inflation for longer |

|

| |

Annuity rates rise 4.3% in May as providers react to soaring gilt yields up 60 basis points. |

|

|

|

|

|

Annuities rise 4.3% in May due to soaring gilt yields up 60 basis points as inflation is expected to remain high for longer and central banks to raise interest rates further.

Central banks are expected to raise interest rates due to inflation remaining higher for longer and the 15-year gilt yields soar 60 basis points from 4.03% to 4.63% in May.

Providers and reacting with higher annuity rates up 4.3%

for our benchmark example for a 65 year old using £100,000 to purchase a single life and level annuity which remains at a fourteen year high.

Find related news here:

Pension annuities up 3pc as yields rise expecting higher base rates

Annuity rates could rise 2pc as gilt yields recover after banking crisis

Core CPE inflation in the US increased slightly from 4.2% in March to 4.4% in April and the Federal Reserve may increase rates by 0.25% when they were suggesting no increase.

In the UK the consumer price index (CPI) inflation decreased from 10.1% in March to 8.7% in April which was higher than expected and the Bank of England is expected to raise base rates now to 5.0%.

|

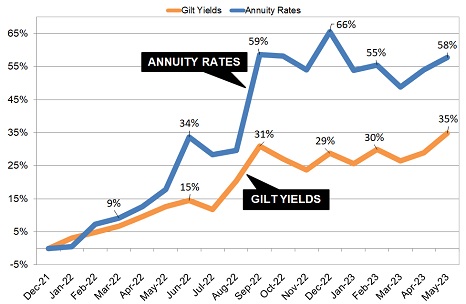

| Fig 1: Chart comparing annuity rates and 15-year gilt yields |

The above chart is based on our benchmark example for a 60 year old using £100,000 to purchase a single life and 3% escalating annuity which remains at a fourteen year high.

Since the recent low of December 2021, annuity rates for this benchmark have increased 58% with a strong increase since March 2023.

This is due to the rapid rise in gilt yields which are up 35% over the same period and at the highest level since the mini budget in September 2022.

Gilt yields have increased from 3.79% at the start of April to 4.63% in May or a rise of 84 basis points. Over this eight week period our benchmark example for a 65 year old with a fund of £100,000 and level income has seen annuity rates up 8.5% or £565 pa from £6,575 pa at the start of April 2023 to £7,140 pa on 26 May 2023.

This means lifetime income has increased in the last eight weeks from an annuity for our benchmark annuitant aged 65. The Office of National Statistics (ONS) would expect a male to live for 18.8 years and he will have £10,622 more over his lifetime by taking an annuity now compared to the start of April 2023. For a female she can expected to live for 21.2 years increasing her lifetime income by £11,978.

For those aged 55 years old with a fund of £100,000, the biggest percentage rise is a 50% joint life annuity with 3% escalation and income up +72% or £1,433 pa since December 2021.

The largest monetary gain with a fund of £100,000, is for those aged 570 years with 50% joint life and level income with percentage rise of +37% and monetary amount of £1,960 pa.

Central banks are expecting inflation to remain higher for longer with base rates likely to rise during the summer.

This means gilt yields are likely remain higher in the 4.0% to 5.0% range. Providers can increase annuity rates although this may be limited to a further 2% in the short term following increases of 4% already in May.

|

|

|

|

|

|

|

| |

Age |

Single |

Joint |

|

|

| |

55 |

£5,783 |

£5,321 |

|

|

| |

60 |

£6,023 |

£5,795 |

|

|

| |

65 |

£6,845 |

£6,413 |

|

|

| |

70 |

£7,826 |

£7,240 |

|

|

£100,000 purchase, level rates, standard

Unisex rates and joint life basis |

|

|

|

|

|

| |

Plan your annuity and get quotes from the 12 leading providers |

|

| |

| |

|

Free Annuity Quotes |

| |

|

No Obligation |

| |

|

From All Providers |

|

|

|

|

|

|

|

|

|

| You can follow the latest annuity updates on Twitter or as a fan on Facebook |

|

| |

|

|

|

|

|