Drawdown benefits from Brexit

An alternative to annuities is flexi-access drawdown that allows you to keep control of your pension fund and take any level of income to meet your needs. The fund is invested in a portfolio reflecting your attitude to investment risk.

|

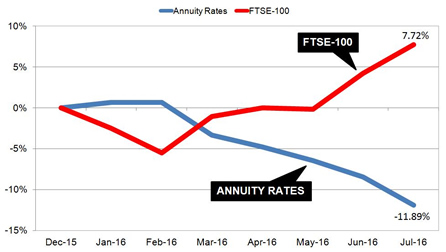

| Fig 1: Chart comparing equity markets and 15-year gilt yields |

The above table shows how the FTSE-100 index has increased 7.72% during 2016 while annuity rates have decreased by 11.89%.

The income taken from flexi-access drawdown is usually between 4% to 5% so the gain in the fund value would exceed the annual income to be taken in the following year. The FTSE-100 has increased by 11.56% from 6,027

after the Brexit vote to 6,724 although many funds will not be as volatile as this index and the growth would be smaller.

For our benchmark a person aged 65 years old with a fund of £100,000 buying a lifetime annuity on a single life, level basis could purchase an income of £5,614 pa at the beginning of the year.

| |

Benchmark annuity rates and gilt yields |

|

| |

Jan |

Feb |

Mar |

Apr |

May |

June |

July |

| Rate |

£5,614 |

£5,633 |

£5,391 |

£5,311 |

£5,217 |

£5,106 |

£4,915 |

| Yield |

1.93% |

1.92% |

1.96% |

2.10% |

1.93% |

1.38% |

1.21% |

|

The above table shows how both gilt yields and annuties have reduced during the year. With the fall in the 15-year gilt yields from 1.93% before the EU Referendum to 1.21% in July, annuity rates have reduced by £699 pa to £4,915 pa.

Over the lifetime of the annuitant based on the Office of National Statistics (ONS) we would expect a male to live for 17.3 years. This would mean he will have £12,092 less over his lifetime and for a female she can expected to live for 20.4 years decreasing her income by £14,259.

Brexit has been a shock to investors creating uncertainty in the short term with a possible economic slowdown. The immediate result has been for investors to seek safe havens until the UK has a more certain future and it may take up to five years for interest rates and gilt yields to make a recovery.

To avoid all time low annuity rates at retirement there are other options such as fixed term annuity and flexi-access drawdown.

|