| |

| 6 February 2026 last updated |

|

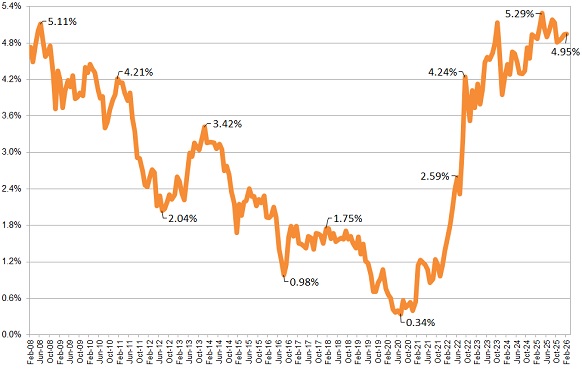

| Latest Gilt Yields Chart |

|

| 15-year gilt yields - last 18 years |

| Based on figures for February 2026 |

|

| |

15-year gilt yields chart is at 4.95% on 6 February 2026

Find out more details:

Monthly analysis of annuities and gilt yields

Annuity rates are based primarily on the 15-year gilt yields so changes in gilt yields will affect annuities. The above chart shows yields at an all time low of 0.162% on 9 March 2020 after concerns over a no-deal Brexit, the US-China trade tensions and fear of recession due to the Coronavirus.

The 15-year gilt yields had reduced significantly since June 2008 due to the financial crisis and since recovered to a record high of 5.29% on 9 April 2025 as interest rates are expected to be higher for longer. |

|

|

|

As a general rule a 30 basis point rise in yields would increase annuities by 3.0% although the providers may take time to introduce these changes depending on their own strategies.

By 1 February 2026 yields were +11 basis points higher than the figures in July 2008 when they were 4.83%.

The 15-year gilt yields increased by +6 basis points to 4.94% during January 2026 with providers of standard annuities decreasing rates by an average -0.17% for this month and rates may rise by +0.77% in the short term if yields remain at current levels.

For smoker and enhanced annuity providers have decreased their rates by an average of -0.98% and rates may rise by +1.58% in the short term if yields remain at current levels.

For the latest updates see Annuity Rates Review. |

| |

|

Annuity Rates Chart

Read the latest annuity rates review to find out if this is the best time to buy an annuity. |

| |

|

|

Annuity Rates Changes

Find out about the latest changes in annuity rates and if they are rising or falling. |

|

|

|

|

|

|

| Single |

|

| |

55 |

£6,506 |

|

|

| |

60 |

£6,850 |

|

|

| |

65 |

£7,658 |

|

|

| |

70 |

£8,410 |

|

|

| Joint |

|

| |

55 |

£6,169 |

|

|

| |

60 |

£6,591 |

|

|

| |

65 |

£7,195 |

|

|

| |

70 |

£7,913 |

|

|

| £100,000 purchase, level and standard rates |

|

|

|

| Annuity Quotes |

| Ask for a free quote with up to 25% more income or 40% for impaired health. |

|

Free quotes |

|

No obligation |

|

All providers |

|

|

|

|

|

| Flex-Access Drawdown |

| • |

Take control of your money |

|

| • |

Easy access |

|

| • |

Tax free cash |

|

| • |

Family benefits |

|

| • |

Keep your fund |

|

|

|

|

|

|

| Follow the latest annuity updates on Twitter or Facebook |

|

| |

|

|

|

|

|

|